Failure to duly make mortgage payments seems to lead to inevitable foreclosure with all unpleasant consequences attached. However, there might be another way out, which is a deed in lieu of foreclosure. This legal instrument serves to release a borrower from financial obligations while transferring the property in question to the lender.

Create a Personalized Deed in Lieu of Foreclosure Form online in under 5 minutes!

Build Your Document

Answer a few simple questions to make your document in minutes

Save progress and finish on any device, download and print anytime

Your valid, lawyer-approved document is ready

. or download your Deed in Lieu of Foreclosure Form as a PDF file Create a Personalized Deed in Lieu of Foreclosure Form online in under 5 minutes! Table of ContentsAs the name suggests, a deed in lieu of foreclosure is a form of agreement between a lender and a borrower, aimed at avoiding a foreclosure procedure, which might be disadvantageous for both parties in some cases. If the parties manage to come to a voluntary settlement, they write the agreement conveying all interest in the property from the mortgagor to the mortgagee. Thus, the former frees themselves of unpaid balances and, in most cases, any other liabilities related to the mortgage loan. The latter saves time and money while getting an opportunity to recoup at least part of their losses related to the default loan.

Since there are other instruments to resolve the issue of delinquent mortgages, both lenders and borrowers should weigh up the pros and cons of opting for a deed in lieu of foreclosure. Being rather helpful in some circumstances, this type of agreement may turn out less favorable or even unacceptable in other scenarios. So, the parties should size up their specific situation while keeping in mind the following common benefits and risks.

It might seem that a mortgage provider can benefit nothing from this agreement since it leaves the mortgagee with some property to be sold before they will be able to cover their losses. However, it still might be a better option compared with foreclosure, as the latter is a quite time-consuming procedure, especially in states with judicial foreclosure. Also, a foreclosure procedure entails repossession costs, which otherwise can be eliminated by the lender. Another scenario the mortgagee should consider before making a decision is the possibility of the borrower filing for bankruptcy. In this case, the mortgage provider will face further delays and expenses, which can be avoided through a voluntary settlement with the mortgagor.

A deed in lieu of foreclosure is surely not the best option for a lender if the real estate in question is encumbered by another mortgage or other liens. Since the agreement transfers legal ownership of the property to the loan supplier, the latter will be liable for all the encumbrances. Besides, the lender might fail to sell the asset gained within a short time and/or for the right price if the property is in poor condition or if the house prices have dropped down.

Borrowers are more likely to ask for a deed in lieu of foreclosure since it saves them from both the financial burden and public dishonor. While they are doomed to lose their homes due to the overdue loan anyway, foreclosure is a more extensive and painful process than arranging a settlement with the lender. A deed in lieu of foreclosure can even cover a deficiency if the outstanding loan amount is higher than the fair market value of the property. The deficiency can be either forgiven in full or significantly reduced. And obviously, foreclosure leaves a spot on a credit reputation, which hampers any attempts to get a loan in the future. Although a deed in lieu of foreclosure shows up on a credit report too, it takes only two years to remove it as against seven years of foreclosure. Besides, if the mortgagee has incentives to get the rights over the property as fast as possible (for example, when the lender has a buyer in sight), the borrower can gain other financial benefits except for the release from the debt obligations. Namely, the mortgage provider can offer a “cash for keys” agreement to have the house vacated fast and left in a good condition.

On the other side, a deed in lieu of foreclosure still spoils the borrower’s credit reputation, not to mention that it deprives the mortgagor of the home. If the latter wants to continue the struggle for the property, it is better to consider alternative ways. Moreover, the borrower can in no way make the loan supplier enter into this agreement, so it all depends on the good will and dealmaking skills of the parties. Nobody can guarantee that the lender would write off the whole debt either. In this case, the debtor will be left without the home and still in debt. But if the creditor agrees to issue a waiver, the shortfall will be considered a taxable gain for the mortgagor, which is also a drawback.

Both a lender and a borrower can initiate negotiations about a deed in lieu of foreclosure, but the latter ones tend to come up with this proposal more often. Upon making the decision, the debtor needs to submit a corresponding application along with documents proving poor financial position. The ower has to clearly express their voluntary offer and the reasons behind it. The loan supplier is obliged to respond with written consent or denial. If the mortgagee accepts the offer, the letter must contain clear conditions under which the party will agree to the ownership transfer. However, the conditions are usually negotiable, so the borrower can proceed with their efforts to arrive at a settlement even if the initial terms are not acceptable.

It is clear that the lender will not be interested in an offer if it is associated with delays, money loss, or probable litigations. So, the most common reasons for a lender to reject an offer are:

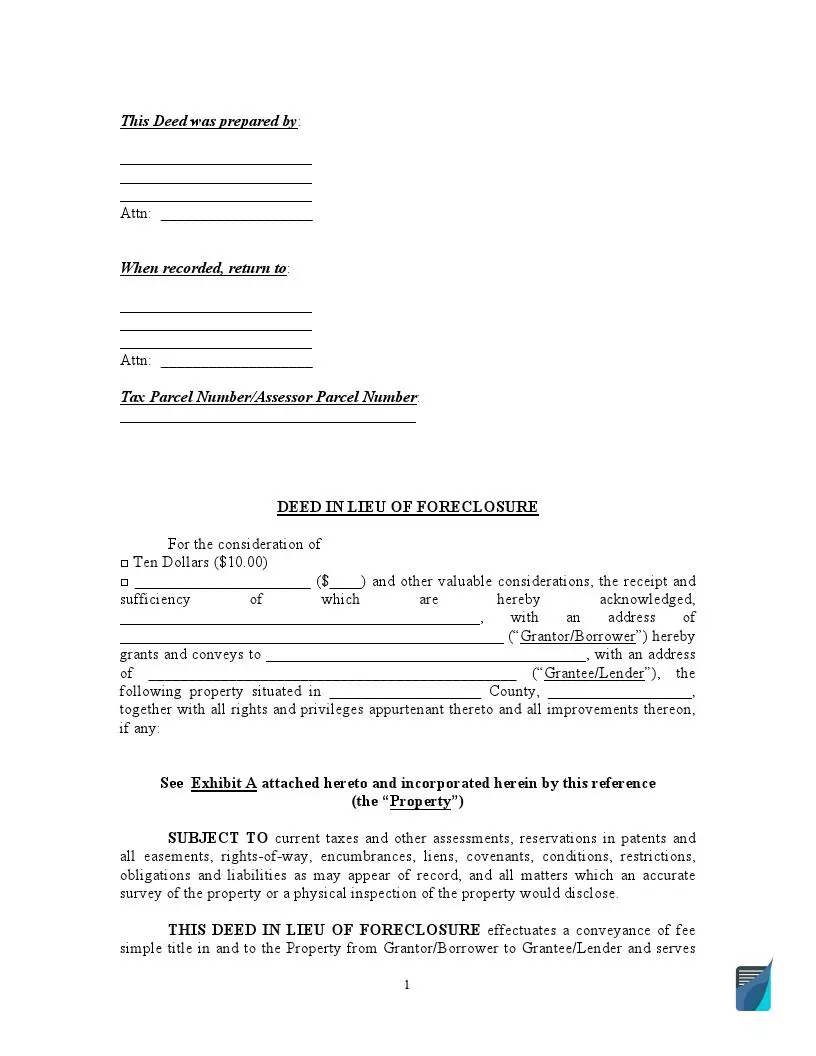

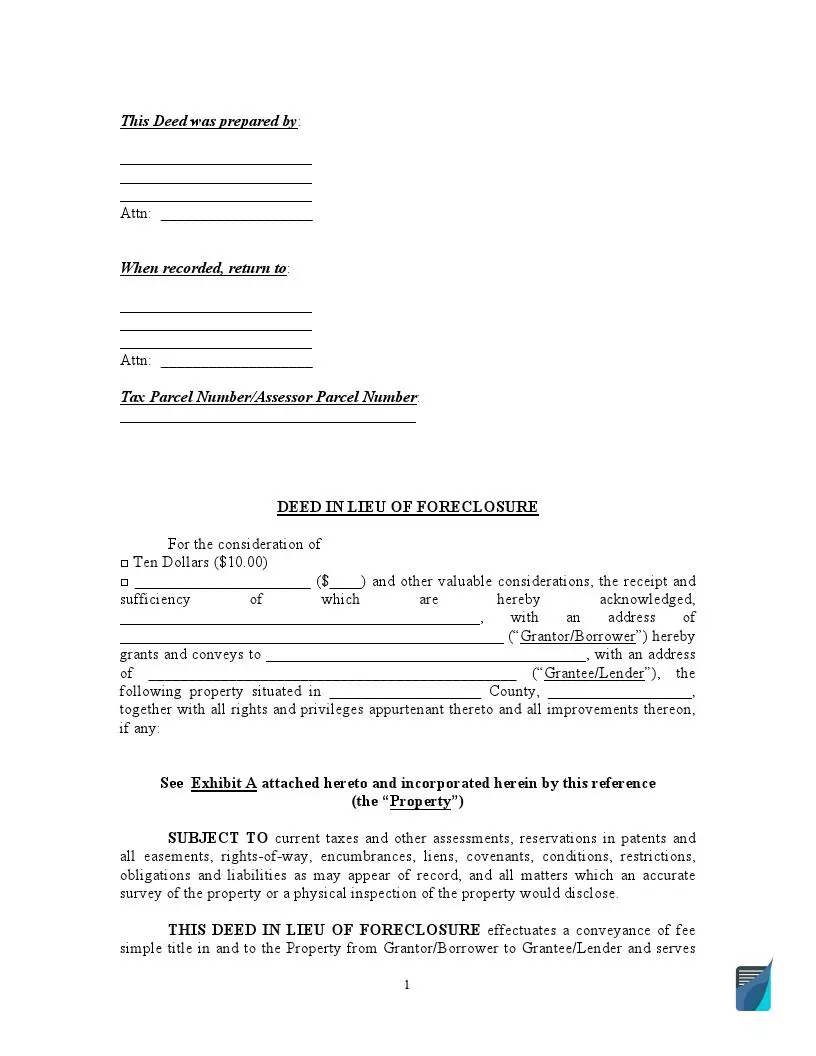

A deed in lieu of foreclosure form can provide a faster way for formalizing the agreement since it requires simple filling out blank spaces with necessary information. The details that must be specified in the settlement for it to be legally valid include:

However, the agreement might contain additional information, for example, associated with a deficiency balance or other conditions the parties agreed upon.